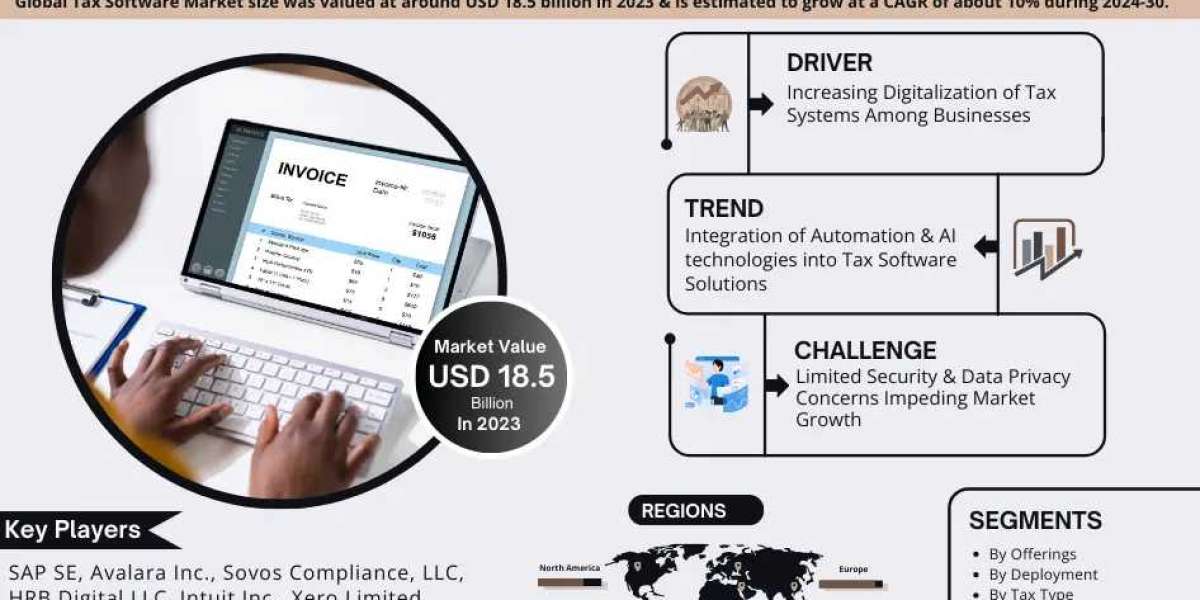

Global Tax Software Market Insights Report Overview

Dive into the latest insights on the Global Tax Software Market with our comprehensive report, accurately curated by the experts at MarkNtel Advisors. Our report offers a thorough examination of the global landscape, providing valuable data, impartial analysis, and strategic insights to drive informed decision-making.

Report's Study Period:

- Historical Period: 2019-22

- Base Year: 2023

- Forecasting Period: 2024-30

We accurately gather data from primary and secondary sources, capturing the industry's historical fluctuations and trends, including market dynamics, consumer behavior, manufacturing insights, and more. Leveraging this data alongside the base year information, we project the industry's trajectory into the future.

Access the Comprehensive PDF Sample Here - https://www.marknteladvisors.com/query/request-sample/tax-software-market.html

Industry Driving Factor:

Expansion of Small and Medium-Sized Enterprises (SMEs) to Offer New Opportunities – SMEs play an important role in increasing the demand for tax software solutions globally. SMEs in emerging markets often operate with limited resources and manpower, making manual tax compliance processes time-consuming, error-prone, and costly. Tax software offers cost-effective solutions tailored to the needs and budget constraints of SMEs, enabling them to automate routine tasks, reduce manual errors, and enhance efficiency in tax preparation and reporting.

In addition, SMEs in emerging markets engage in cross-border trade, and they operate in multiple tax jurisdictions, requiring tax software solutions that support international tax compliance. Tax software dealers offer multi-jurisdictional support, localization features, and expertise in international taxation, which positively address the challenges faced by SMEs in navigating diverse regulatory environments. Hence, with the rising expansion of SMEs, the demand for tax software solutions is anticipated to increase in the forthcoming years.

Segmentation Summary: Global Tax Software Market

Our report delves into the intricate segmentation of the Tax Software Market, providing insights into each subdivision's trajectory, trends, and advancements. This analysis empowers stakeholders to navigate the industry landscape with precision, understanding the nuances of each segment.

-By Enterprise Type

- Large Enterprises

- Small Medium Enterprises (SMEs)

Out of these, the Small Medium Enterprises (SMEs) have been dominating the Global Tax Software Market during the past few years. The number of SMEs across regions like South America, APAC, etc. has also showcased tremendous proliferation due to the healthy entrepreneurial ecosystem and supportive government measures. Countries such as Brazil, India, Saudi Arabia, etc., assisted in the form of business counseling, financial support advice, technical support guidance, etc., which led to the development of new SMEs across the globe.

-By Offerings

- Tax Software- Market Size Forecast 2019-2030, (USD Million)

- Services- Market Size Forecast 2019-2030, (USD Million)

-By Deployment

- Cloud- Market Size Forecast 2019-2030, (USD Million)

- On-premise- Market Size Forecast 2019-2030, (USD Million)

-By Tax Type

- Sales Tax- Market Size Forecast 2019-2030, (USD Million)

- Income Tax- Market Size Forecast 2019-2030, (USD Million)

- Others (VAT, Service Tax, Estate Tax, etc.)- Market Size Forecast 2019-2030, (USD Million)

-By End User

- IT Telecom- Market Size Forecast 2019-2030, (USD Million)

- BFSI- Market Size Forecast 2019-2030, (USD Million)

- Government- Market Size Forecast 2019-2030, (USD Million)

- Retail Consumer Goods- Market Size Forecast 2019-2030, (USD Million)

- Healthcare- Market Size Forecast 2019-2030, (USD Million)

- Others (Hospitality, Education, etc.)- Market Size Forecast 2019-2030, (USD Million)

Read Full Report - https://www.marknteladvisors.com/research-library/tax-software-market.html

Leading Competitive: Global Tax Software Market

- SAP SE

- Avalara Inc.

- Sovos Compliance, LLC

- HRB Digital LLC

- Intuit Inc.

- Xero Limited

- Thomson Reuters

- Wolters Kluwer N.V.

- Drake Software

- TaxSlayer LLC

- Sage Group plc

- ClearTax

- TaxJar

- TaxACT

- Rethink Solutions Inc.

- Others

Geographical Reach:

The Tax Software Industry spans across various regions, each characterized by unique cultural, regulatory, and economic factors. Our regional analysis provides a comprehensive overview and forecast, considering these differences and assessing market players' presence, consumer preferences, and more.

-By Region

- North America

- South America

- Europe

- The Middle East Africa

- Asia-Pacific

For inquiries or further discussions, connect with our analyst today to unlock the full potential of the Tax Software Industry.

Request Customization - https://www.marknteladvisors.com/query/request-customization/tax-software-market.html

Key Focus Areas:

- What are the primary drivers and trends influencing the Tax Software Industry's growth, and how is the market structured?

- How are segments within the Tax Software Industry defined, and what is the size of each segment?

- Which segments and geographical regions present the most promising growth opportunities?

- What does the competitive landscape look like, and how do key players position themselves within the market?

More Reports:

- https://hanzuzhisheng.com/read-blog/731

- https://ameblo.jp/markntel/entry-12843381765.html

- https://plaza.rakuten.co.jp/insightpulse/diary/202403060000/

- https://note.com/irene_garcia/n/n0ed05b2bfc71?sub_rt=share_pb

- https://iwa.co.id/pasar-kamera-otomotif-melonjak-dengan-perkiraan-cagr-173-untuk-2024-30/

About Us

MarkNtel Advisors is a leading market research company, consulting, data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial varied client base, including multinational corporations, financial institutions, governments, individuals, among others.

Our specialization in niche industries emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing forecasting, trend analysis, among others, for 14.8 diverse industrial verticals.

Media Representative

Company Name: MarkNtel Advisors

Email: sales@marknteladvisors.com

Phone: + +1 628 895 8081, +91 120 4278433