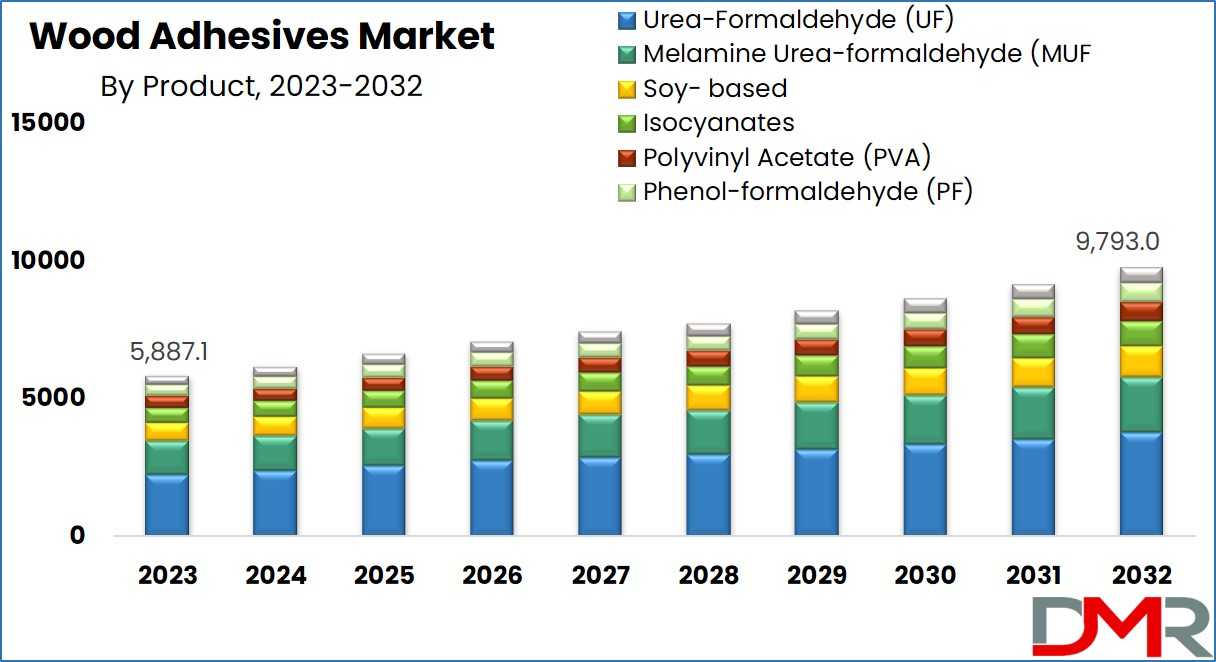

The Global Wood Adhesives Market is experiencing a substantial surge, projected to achieve a value of USD 5,887.1 million by the year 2023. This thriving industry anticipates a compound annual growth rate (CAGR) of 5.8% for the forecast period spanning from 2023 to 2032. The growth trajectory of this market is intrinsically linked to the escalating production of engineered wood panels.

Wood Adhesives: A Key Driver in Panel Manufacturing

Understanding the Market Growth

The increasing demand for engineered wood panels, such as oriented strand board, plywood, and particle board, is a major catalyst driving the surge in the wood adhesives sector. These panels require a substantial amount of adhesives in their manufacturing processes, playing a pivotal role in their structural integrity and versatility. For instance, plywood, a widely utilized wood panel, is crafted by bonding veneers using adhesives.

Get a Free Sample of This @ https://dimensionmarketresearch.com/report/wood-adhesives-market/request-sample

Market Dynamics

In the realm of wood adhesives, major manufacturers across the Asia-Pacific region predominantly rely on internal production capabilities to manufacture adhesives required for their products. However, smaller to medium-sized panel manufacturers often lack the infrastructure necessary for quality control and adhesive production, thereby underscoring the importance of skilled operators for adhesive configuration and quality assurance.

The Wood Adhesive Market operates within stringent regulations aimed at curbing formaldehyde emissions during wood panel development. These regulations are pivotal in fostering fresh growth opportunities for adhesive types like polyurethane, soy-based, and polyvinyl acetate in the forthcoming years. Simultaneously, the market is poised for expansion owing to increased renovation projects and a surge in construction ventures.

Driving Forces Behind the Market

Influence of Renovation Trends

The burgeoning trend of renovation and remodeling projects, largely driven by upgraded standards of living, is significantly contributing to the demand for wood adhesives. Furthermore, the burgeoning service industries in developing nations are propelling the development of corporate buildings and office spaces, thereby amplifying the need for wood furniture and subsequently boosting the wood adhesives industry's growth.

Environmental Consciousness and Market Growth

Concerns about global warming and deforestation have prompted a shift towards engineered wood panels, necessitating a considerable volume of adhesives. Additionally, the growing customer base, enhanced awareness of environmental issues, and continuous research and development activities are projected to further intensify the demand for bio-based wood adhesives in the market.

Key Takeaways:

- Market Growth: The Wood Adhesives Market is projected to reach USD 5,887.1 million by 2023 with a CAGR of 5.8% till 2032, driven by increased production of engineered wood panels.

- Segmentation Analysis: The market is categorized by product, substrate, technology, and application, with UF and PB dominating segments in 2023.

- Influence of Regulations: Stringent regulations focusing on reducing formaldehyde emissions are opening avenues for eco-friendly adhesives like polyurethane and soy-based adhesives.

- Market Drivers: Renovation trends, environmental concerns, and increasing demand for wood furniture are propelling the growth of wood adhesives globally.

- Regional Dominance: The Asia Pacific region, led by China's wood panel sector, commands a substantial share in the market, fostering industrial growth.

Reach out To Over Analysis and Expert For any Request@ https://dimensionmarketresearch.com/enquiry/wood-adhesives-market

Research Scope and Analysis

Analysis by Product

In 2023, the Urea-formaldehyde (UF) segment holds sway in the market, capturing a significant revenue share due to its widespread usage as a thermosetting resin in wood applications. However, UF adhesives exhibit a drawback concerning poor water resistance. Conversely, Melamine Urea-formaldehyde (MUF) resins are gaining traction for their improved water resistance, particularly in the manufacturing of bamboo or bamboo laminate tiles.

Analysis by Substrate

The Particleboard (PB) segment emerges as a dominant player in the substrate category in 2023, thanks to its cost-effectiveness and advantages such as higher density, lower cost, and uniformity. Simultaneously, the Oriented Strand Board (OSB) segment is gaining ground as a compelling substitute to solid boards and plywood, especially in Europe and North America.

Analysis by Technology

Water-based technology commands the lion's share of the wood adhesives market, propelled by the rising preference for environmentally friendly solutions and initiatives aimed at reducing volatile organic compound (VOC) emissions. Europe and North America are actively phasing out solvent-based adhesives, thereby driving the growth of water-based and reactive adhesives.

Analysis by Application

The furniture application segment currently leads the market, driven by the increasing adoption of wood panels for their impeccable finish, lightweight nature, and durability. Conversely, the flooring sector is poised for rapid expansion due to rising per capita income and a growing demand for residential spaces, fueling the need for quality flooring solutions.

Recent Development

- January 2023: Sika launched MB EZ Rapid, a single-component, rapid-drying moisture barrier and adhesive substrate consolidator made with bio-based ingredients. This caters to the growing demand for low-VOC and sustainable adhesives.

- February 2023: Henkel partnered with Stora Enso to develop bio-based wood adhesives for CLT (cross-laminated timber) panels. This collaboration aims to reduce the environmental impact of building materials.

- May 2023: Dow announced the expansion of its OPULON™ bio-based wood adhesive product line, offering more options for furniture and woodworking applications.

Segmentation of the Wood Adhesives Market

By Product

- Melamine Urea-formaldehyde (MUF)

- Urea-Formaldehyde (UF)

- Phenol-formaldehyde (PF)

- Isocyanates

- Polyvinyl Acetate (PVA)

- Soy-based

- Others

By Substrate

- Solid wood

- Oriented Strand Board (OSB)

- Plywood

- Particle Board (PB)

- Medium-density Fiberboard (MDF)

- High-density Fiberboard (HDF)

- Others

By Technology

- Solvent-Based

- Water-Based

- Solventless

By Application

- Furniture

- Doors Windows

- Flooring Decks

- Housing Components

- Others

Regional Analysis

The Asia Pacific region dominates the market, holding a substantial 48.4% of the total revenue share in 2023. China, in particular, stands out significantly in the wood panel sector, being the world's largest producer. The rapid pace of industrialization and urbanization in the region is expected to drive significant market growth in the coming years.

Prominent Players in the Market

Several notable entities contribute to the thriving Wood Adhesives Market, including:

- Henkel AG Co., KGaA

- Bostik S.A.

- H.B Fuller

- 3M

- Sika AG

- Ashland, Inc.

- Pidilite Industries Ltd.

- Jubilant Industries Ltd.

- AkzoNobel N.V

- Franklin Adhesives Polymers

- DowDuPont Inc.

- Minnesota

- Other Key Players

In conclusion, the Wood Adhesives Market is poised for substantial growth, fueled by evolving trends in construction, renovation, and environmental consciousness. As the industry continues to innovate and adapt to stringent regulations, it's anticipated to witness a paradigm shift towards eco-friendly, sustainable solutions, thereby shaping the market's trajectory for years to come.