Ruthenium is a rare transition metal belonging to the platinum group, known for its high resistance to corrosion and excellent catalytic properties. It is widely used in electronics, chemical catalysis, and as an alloying agent in platinum and palladium. Understanding the ruthenium price trend is crucial for industries involved in electronics, catalysis, and materials science. This article provides a comprehensive analysis of ruthenium prices, examining the factors influencing these trends, regional variations, and future market forecasts.

Market Overview

Ruthenium is primarily obtained as a byproduct of platinum and nickel mining. Its market is influenced by several factors, including mining output, demand from various industrial sectors, technological advancements, and global trade policies. The price of ruthenium is also affected by the availability of other platinum group metals (PGMs), as they share similar production sources and end-uses.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/ruthenium-price-trends/pricerequest

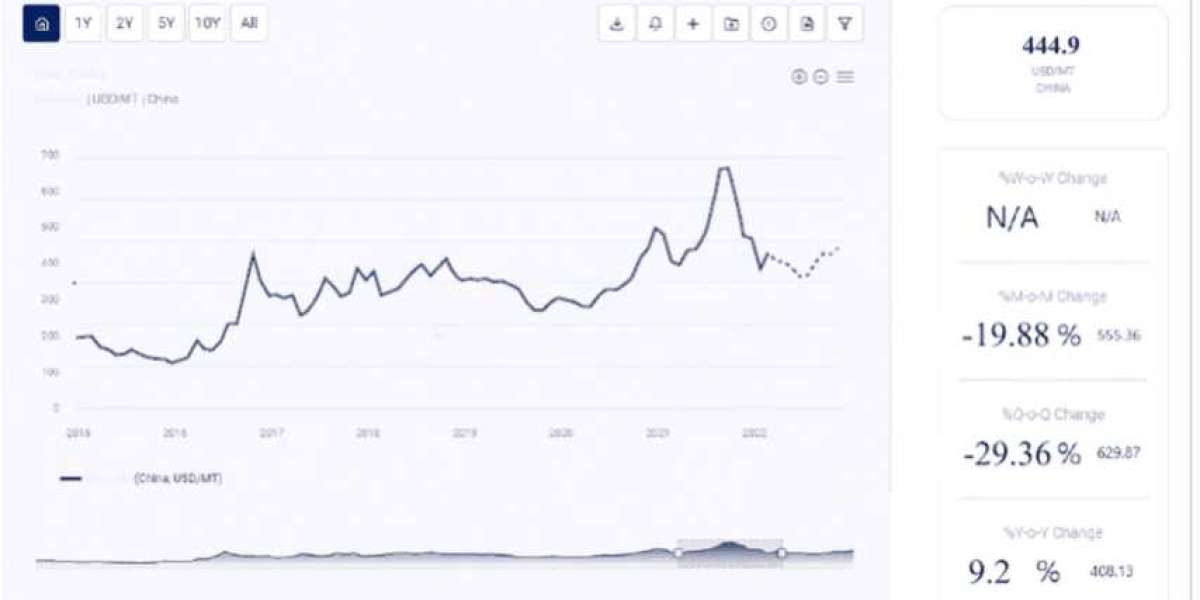

Current Ruthenium Price Trends

As of mid-2024, ruthenium prices have shown variability due to various market dynamics. The average global price of ruthenium ranges between $300 and $450 per ounce. Several key factors contribute to these price trends:

Mining Output: The supply of ruthenium is closely tied to the mining of platinum and nickel. Fluctuations in the production levels of these metals directly impact the availability and price of ruthenium.

Industrial Demand: High demand from the electronics industry, where ruthenium is used in chip resistors and electrical contacts, significantly influences its price. Additionally, the use of ruthenium in chemical catalysis and as an alloying agent adds to its demand.

Technological Advancements: Advances in technology that increase the efficiency of ruthenium usage or find new applications for the metal can drive demand and affect prices.

Global Trade Policies: Trade policies, including tariffs and import/export restrictions, can significantly affect the price of ruthenium. Changes in trade agreements or geopolitical tensions can disrupt supply chains, leading to price volatility.

Economic Conditions: Global economic conditions influence industrial activity and, consequently, the demand for ruthenium. Economic downturns can lead to reduced demand and lower prices, while economic growth can drive demand and increase prices.

Regional Price Variations

The price of ruthenium varies across different regions due to local production capacities, demand levels, and regulatory environments. Here is a regional analysis of ruthenium prices:

North America: In the United States and Canada, ruthenium prices range from $310 to $450 per ounce. Prices are influenced by demand from the electronics and automotive sectors, as well as import costs and tariffs.

Europe: In Europe, the price of ruthenium varies between $300 and $440 per ounce. The region’s demand for ruthenium in chemical catalysis and electronics, along with import regulations, contribute to these prices. Countries like Germany and the UK have significant markets for ruthenium.

Asia-Pacific: The Asia-Pacific region, including countries like China, Japan, and South Korea, is a significant market for ruthenium. Prices in this region range from $300 to $430 per ounce. Growing industrialization and increasing demand for electronics and chemical catalysts drive the market.

Latin America: In Latin America, the price of ruthenium ranges from $310 to $440 per ounce. The region’s growing industrial sector and varying levels of domestic production capacity are key factors influencing prices. Countries like Brazil and Mexico are major consumers of ruthenium.

Middle East and Africa: Prices in the Middle East and Africa vary between $310 and $450 per ounce. The region’s production capacities, particularly in South Africa where ruthenium is a byproduct of platinum mining, contribute to the market dynamics. Import dependencies in some countries can also lead to price fluctuations.

Factors Influencing Ruthenium Prices

Several factors play a crucial role in determining the prices of ruthenium:

Mining Output: The production levels of platinum and nickel, which yield ruthenium as a byproduct, are primary drivers of ruthenium supply and pricing. Any disruptions in the mining of these metals can impact ruthenium availability and prices.

Industrial Demand: The demand for ruthenium from the electronics, chemical, and automotive industries significantly influences its price. High demand from these sectors can drive prices up, while reduced demand can lead to price decreases.

Technological Innovations: Innovations that improve the efficiency of ruthenium usage or discover new applications for the metal can impact its market price. Technological advancements that create new market opportunities can influence price trends.

Global Trade Policies: Trade policies, tariffs, and geopolitical events can affect ruthenium prices by influencing the global supply chain. Restrictions on exports or imports can create supply shortages or surpluses, impacting prices.

Economic Conditions: Global and regional economic conditions influence the demand for industrial products containing ruthenium. Economic growth can drive increased consumption in industrial sectors, while economic downturns can reduce demand and lower prices.

Applications of Ruthenium

Understanding the diverse applications of ruthenium can provide insights into the factors driving its demand and, consequently, its price. Some of the primary applications include:

Electronics: Ruthenium is widely used in the electronics industry for chip resistors, electrical contacts, and hard disk drives. The demand from the electronics sector significantly drives the market.

Chemical Catalysis: Ruthenium is used as a catalyst in various chemical reactions, including hydrogenation and ammonia synthesis. The demand from the chemical industry impacts the market dynamics.

Alloying Agent: Ruthenium is used as an alloying agent in platinum and palladium alloys to improve their hardness and resistance to corrosion. The demand from the jewelry and automotive industries influences the market.

Electrochemical Applications: Ruthenium is used in electrochemical applications such as fuel cells and supercapacitors. The demand from the energy sector impacts the market.

Future Price Forecast

The future outlook for ruthenium prices is influenced by various factors, including market demand, production capacities, technological advancements, and regulatory changes. Here are some key trends and predictions for the future:

Stable Mining Output: If the production levels of platinum and nickel remain stable, it is likely that the supply of ruthenium will also stabilize. However, any significant changes in mining output or supply chain disruptions could impact ruthenium prices.

Growing Demand from End-Use Industries: The demand for ruthenium from various industries, such as electronics, chemical catalysis, and energy, is expected to continue growing. This increasing demand will likely support price stability or even lead to price increases.

Technological Innovations: Advances in production technology and the development of new applications for ruthenium could drive market growth. Innovations that enhance production efficiency or create new market opportunities may help stabilize or reduce prices.

Environmental and Regulatory Factors: Stricter environmental regulations and sustainability initiatives may impact production processes and costs. Compliance with these regulations could lead to increased production costs, potentially driving prices up.

Economic Recovery: The global economic recovery from the COVID-19 pandemic is expected to boost demand for industrial products containing ruthenium. This increased demand may support higher prices in the short to medium term.

Regional Market Dynamics: Regional differences in production capacity, demand, and regulatory environments will continue to influence ruthenium prices. Markets with strong demand and limited supply may experience higher prices, while regions with surplus production capacity may see more stable or lower prices.

Conclusion

The ruthenium market is influenced by a complex interplay of factors, including mining output, industrial demand, technological advancements, regulatory changes, and economic conditions. As of mid-2024, the average global price of ruthenium ranges between $300 and $450 per ounce, with regional variations.

Looking ahead, the future price of ruthenium is expected to be shaped by stable mining output, growing demand from various industries, technological innovations, and regulatory factors. Businesses involved in the production, distribution, or utilization of ruthenium should closely monitor these trends to make informed decisions and optimize their operations.

In summary, while the ruthenium market faces several challenges and uncertainties, it also presents opportunities for growth and innovation. By understanding the key factors influencing prices and staying abreast of market developments, businesses can navigate the dynamic landscape and achieve long-term success.