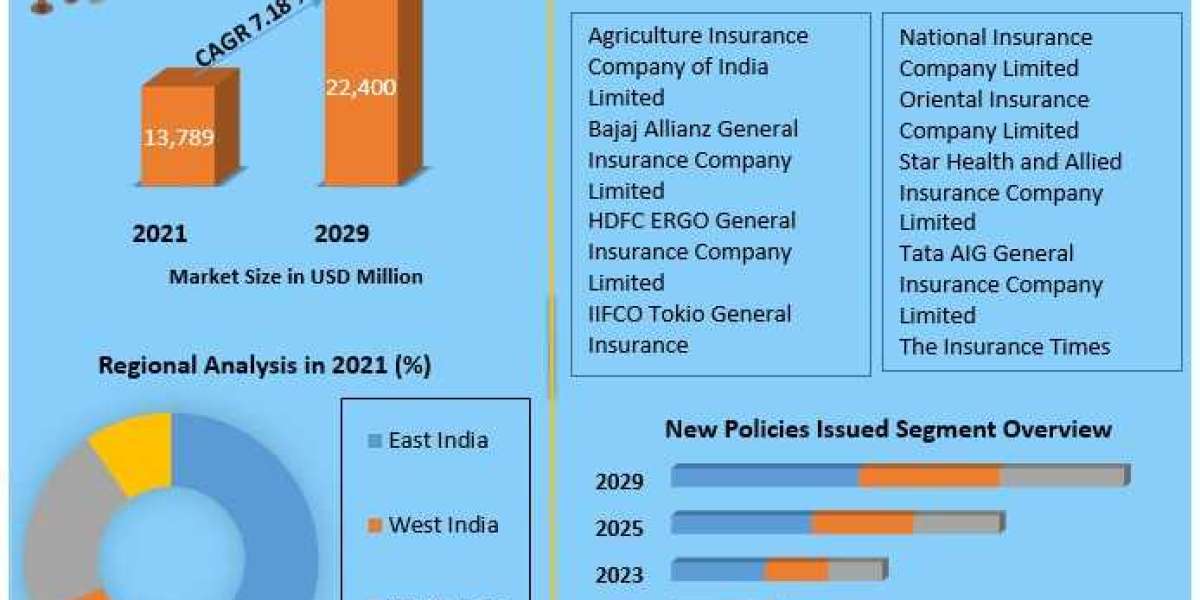

India Non-Life Insurance Market was valued at US$ 13, 7889 Mn. in 2021 and is expected to grow at US$ 22,400 Mn. in 2029. India Non-Life Insurance Market size is expected to grow at a CAGR of 7.18 % through the forecast period.

India Non-Life Insurance Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “India Non-Life Insurance Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The report provides the current state of the India Non-Life Insurance Market by thorough analysis, and projections are made up to 2030.

Get your sample copy of this report now : https://www.maximizemarketresearch.com/request-sample/42091/

India Non-Life Insurance Market Scope and Methodology:

The report analyzes the India Non-Life Insurance Market by dividing it into segments and conducting various regional analyses to offer a definition, description, and forecast. It necessitates thorough qualitative and quantitative research in addition to various key market attributes. The research involves examining competition, analyzing competitors, evaluating industries, studying financial effects, understanding viewpoints, tracking market trends, and estimating market size.

This report extensively analyzes the opportunities, challenges, drivers, and future trends in the market. It looks at past data and considers various possible market situations. The research meticulously analyzes the market's possibilities, market behavior, chances for growth, market divisions, geographical influences, examination of competitors, and predictions through suitable methods and hypotheses. The research also involves evaluating the value chain, studying impacts, conducting PESTLE analysis, and PORTER analysis.

India Non-Life Insurance Market Regional Insights

The report provides a more detailed analysis of the markets in Asia Pacific, Europe, North America, South America, and the Middle East. Having a good grasp of the intricate operations of the worldwide India Non-Life Insurance Market industry is crucial for the geographical analysis in the research. The report includes data on market size, growth rates, and commodity trade in every country. The report also outlines the latest progress in the worldwide India Non-Life Insurance Market in different countries and regions.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/42091/

India Non-Life Insurance Market Segmentation

by Product

• Motor insurance

• Health insurance

• Fire insurance

• Marine insurance

• Others

In 2021, the vehicle insurance segment had the biggest market share based on product. A notable increase in the need for cars and the requirement for auto insurance throughout India. The study offers a thorough segment analysis of the non-life insurance industry in India, offering insightful information at both the macro and micro levels. The coverage includes damage and destruction to the vehicle caused by typhoons, earthquakes, floods, and other natural disasters. It also includes coverage for harm and destruction to the car brought on by riots, strikes, burglaries, and theft. When travelling, the cover provides security for both co-passengers and the vehicle's owner/driver.

by New Policies Issued

• Public insurer

• Private insurer

• Specialize insurer

by Distribution Channel

• Individual agents

• Corporate agents - banks

• Corporate agents - others

• Brokers

• Direct business

• Others

Table of Content: India Non-Life Insurance Market :

Part 01: Executive Summary

Part 02: Scope of the India Non-Life Insurance Market Report

Part 03: India Non-Life Insurance Market Landscape

Part 04: India Non-Life Insurance Market Sizing

Part 05: India Non-Life Insurance Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

India Non-Life Insurance Market Key Players

• Agriculture Insurance Company of India Limited

• Bajaj Allianz General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• IIFCO Tokio General Insurance

• National Insurance Company Limited

• Oriental Insurance Company Limited

• Star Health and Allied Insurance Company Limited

• Tata AIG General Insurance Company Limited

• The New India Assurance Company Limited

• The Insurance Times

• ICICI Bank

• Mahindra Insurance Brokers Limited

• Royal Sundaram General Insurance Co. Limited

• Universal Sompo General Insurance Co. Ltd.

Looking for insights on the market? Don’t miss the summary of the research report : https://www.maximizemarketresearch.com/request-sample/42091/

Key questions answered in theIndia Non-Life Insurance Market are:

- What is India Non-Life Insurance Market?

- What was the India Non-Life Insurance Market size in 2023?

- What will be the CAGR at which the India Non-Life Insurance Market will grow?

- What are the upcoming industry applications and trends for the India Non-Life Insurance Market?

- What are the different segments of the India Non-Life Insurance Market?

- What segments are covered in the India Non-Life Insurance Market?

- Which are the factors expected to drive the India Non-Life Insurance Market growth?

- What growth strategies are the players considering to increase their presence in India Non-Life Insurance Market?

- Who are the key players in the India Non-Life Insurance Market?

- Who are the leading companies and what are their portfolios in India Non-Life Insurance Market?

- What is the growth rate of the India Non-Life Insurance Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the India Non-Life Insurance Market?

To delve deeper into this research, please follow this link: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

Key Offerings:

- Past Market Size and Competitive Landscape (2024 to 2030)

- Past Pricing and price curve by region (2024 to 2030)

- Market Size, Share, Size Forecast by different segment | (2024 to 2030)

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656