The federal withholding feature in QuickBooks automatically calculates the appropriate amount of federal income tax that needs to be withheld from an employee's paycheck based on their earnings, filing status, and other factors.

This feature is crucial for ensuring that businesses comply with federal tax regulations and that employees receive the correct net pay.

When the federal withholding calculation is not working correctly, it can lead to underpayment or overpayment of taxes, resulting in penalties, audits, and employee dissatisfaction.

In this article, we will explore the issue of federal withholding not calculating correctly in QuickBooks.

Reasons Why Federal Withholding May Not Be Calculating in QuickBooks

There are several potential reasons why the federal withholding may not be calculated correctly in QuickBooks. Some of the most common issues include:

Outdated Tax Tables:

QuickBooks relies on up-to-date tax tables to accurately calculate federal withholding. If the tax tables are not updated, the calculations may be inaccurate.

Incorrect Employee Information:

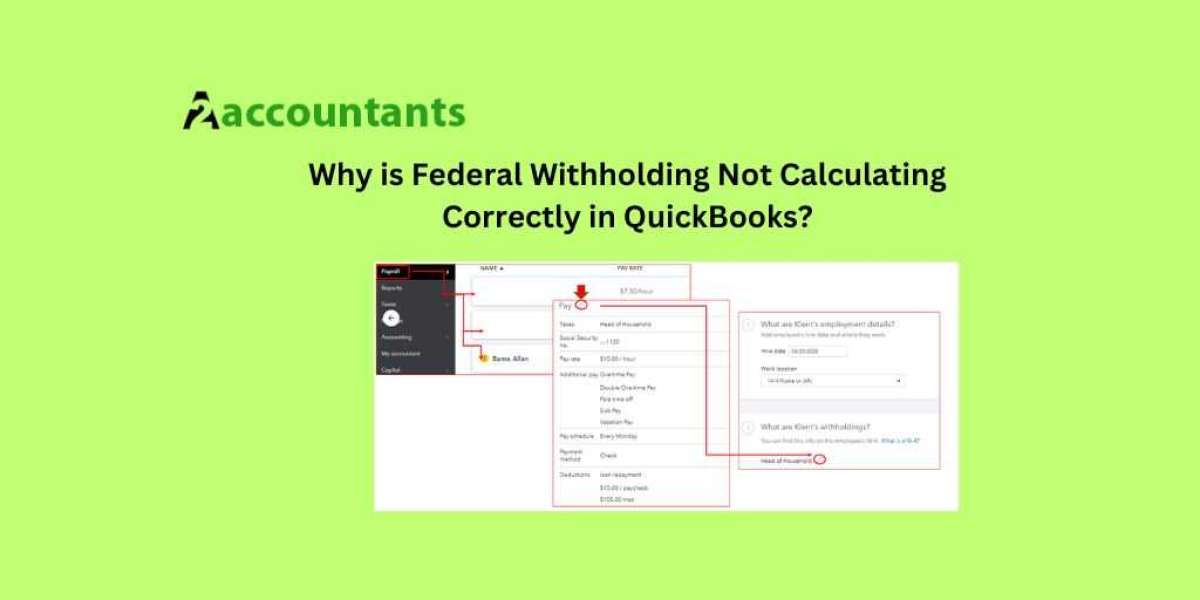

Inaccurate or incomplete employee information, such as filing status, allowances, or other personal details, can lead to incorrect federal withholding calculations and QuickBooks Payroll Not Calculating Taxes.

Payroll Setup Issues:

Problems with the payroll setup in QuickBooks, such as incorrect pay schedules, pay frequencies, or payroll items, can also contribute to federal withholding not calculating errors.

Software Conflicts:

Conflicts between QuickBooks and other software or applications installed on the same system can sometimes interfere with the federal withholding calculation.

QuickBooks Software Bugs:

In rare cases, the issue may be due to a bug or glitch in the QuickBooks software itself, which may require an update or patch to resolve.

Troubleshooting Steps to Fix Federal Withholding Calculation Issues

To address the federal withholding calculation issues in QuickBooks, follow these troubleshooting steps:

1. Checking and Updating Tax Tables in QuickBooks

- Verify Tax Table Version: In QuickBooks, go to the "Payroll" menu, then select "Payroll Tax Forms and W-2s" and "Payroll Tax Tables." Check the tax tables' versions to ensure they are up-to-date.

- Update Tax Tables: If the tax tables are outdated, you can update them by selecting "Update Payroll Tax Tables" and following the on-screen instructions. This will ensure that QuickBooks uses the latest federal and state tax information.

- Recalculate Payroll: After updating the tax tables, recalculate the payroll to see if the federal withholding is now being calculated correctly.

2. Verifying Employee Information and Payroll Setup

- Review Employee Information: Ensure that all employee information, such as filing status, allowances, and other personal details, is accurate and up-to-date in QuickBooks.

- Examine Payroll Setup: Check the payroll setup in QuickBooks, including pay schedules, pay frequencies, and payroll items, to ensure they are configured correctly.

- Update Employee and Payroll Information: If any issues are found, update the employee information and payroll setup accordingly, then recalculate the payroll to see if the federal withholding is now being calculated correctly.

3. Resolving Software Conflicts and Updating QuickBooks

- Identify Potential Conflicts: Determine if there are any other software or applications installed on the same system that may be interfering with QuickBooks' federal withholding calculations.

- Troubleshoot Conflicts: If a conflict is identified, disable or uninstall the conflicting software, then recalculate the payroll to see if the issue is resolved.

- Update QuickBooks: If the issue persists, check for any available QuickBooks updates and install them. Updating the software may resolve any underlying bugs or glitches causing the federal withholding calculation problem.

Conclusion

Accurate federal withholding calculation is essential for maintaining compliance and ensuring employees receive the correct net pay.

By following the troubleshooting steps outlined in this guide, you can effectively address common issues with federal withholding not calculating correctly in QuickBooks.