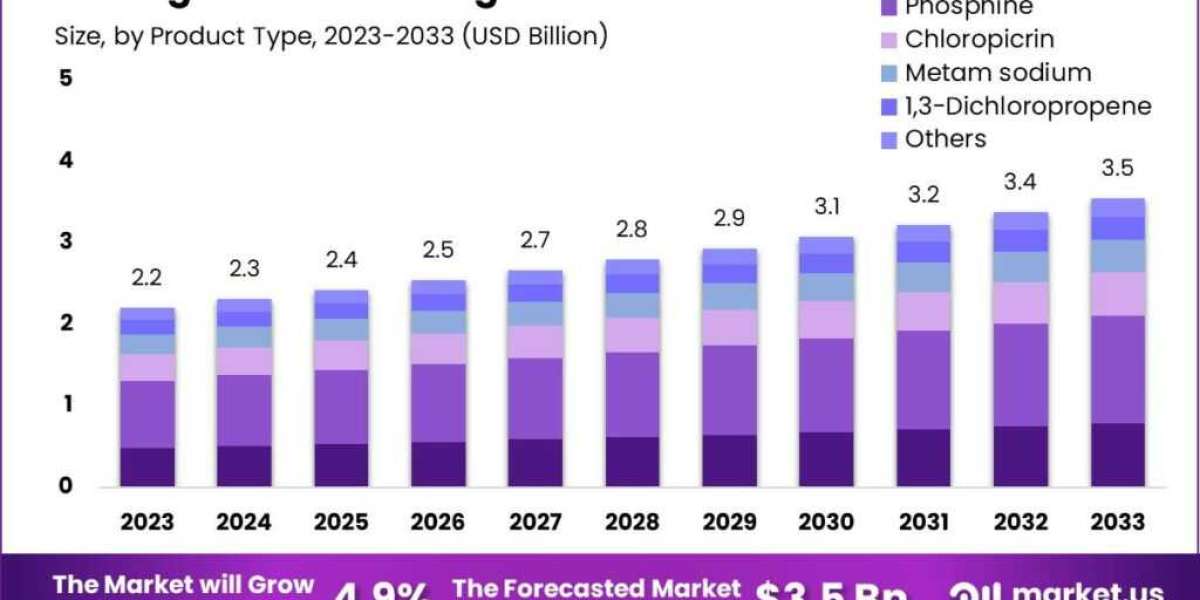

The global agricultural fumigants market size is expected to be worth around USD 3.5 billion by 2033, from USD 2.2 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The agricultural fumigants market involves the production and use of chemicals designed to control pests and pathogens in soil and storage facilities, ensuring crop protection and enhancing agricultural productivity. These fumigants, which include substances like methyl bromide, phosphine, and chloropicrin, are applied to eliminate a wide range of pests such as insects, nematodes, fungi, and weeds, thus preventing crop damage and loss. The market's growth is driven by the increasing need for high crop yield, the demand for quality produce, and the necessity to manage pest resistance. However, the market also faces challenges due to stringent environmental regulations, potential health risks, and the ongoing shift towards sustainable and eco-friendly pest management solutions.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- Syngenta

- Nufarm

- ADAMA

- SGS SA

- UPL

- Solvay

- Intertek

- AMVAC

- Tessenderlo Kerley, Inc.

- DEGESCH America, Inc.

- MustGrow Biologics, Inc

- Trinity Manufacturing, Inc.

- The Draslovka Group

- Douglas Products

- Royal Agro

- Imtrade CropScience

- Nippon Chemical Industrial Co., LTD.

- Ecotec Fumigation

- Arkema

Click here for request a sample: https://market.us/report/agricultural-fumigants-market/request-sample/

Product Analysis:

In 2023, Phosphine led the Agricultural Fumigants Market with over 37.5% market share due to its effectiveness in pest control across various crops. Its lower vapor pressure, higher degradation rates, and superior soil stability make it popular despite its toxicity and flammability, requiring careful application by authorized personnel in tightly sealed areas. Improper use can pose significant health risks.

Crop Type Analysis:

In 2023, Cereals Grains dominated the Agricultural Fumigants Market with over 42.6% market share, driven by the need to protect staple crops like wheat, rice, and corn from pests. The Oilseeds Pulses segment also held a significant share due to the vulnerability of crops like soybeans and lentils. Fruits Vegetables saw notable usage to safeguard perishable crops, while niche crops in the “Others” category required tailored fumigation solutions.

Pest Control Method Analysis:

In 2023, Structural pest control methods led the Agricultural Fumigants Market with over 38.2% market share due to their effectiveness in enclosed spaces like warehouses. Tarpaulin fumigation was prominent for field applications, while vacuum chamber fumigation catered to high-value goods. Injection methods and specialized techniques also contributed significantly.

Form Analysis:

In 2023, Gas was the leading form in the Agricultural Fumigants Market, capturing over 48.6% market share due to its versatility and effectiveness. Solid forms, including powders and pellets, were valued for their ease of use and environmental safety. Liquid fumigants offered flexibility in application, while gaseous fumigants required careful handling to prevent environmental harm.

Function Analysis:

In 2023, Insecticides dominated the Agricultural Fumigants Market with over 42.8% market share, due to their effectiveness in controlling insect pests. Fungicides and nematicides followed, targeting fungal diseases and nematodes, respectively. Herbicides, though smaller in market share, played a crucial role in weed management, supporting healthy crop growth.

Application Analysis:

In 2023, Warehousing applications dominated the Agricultural Fumigants Market with over 55.4% market share, reflecting the importance of protecting stored crops from pest infestations. Soil applications, important for pre-planting pest control, held a smaller share, underscoring the emphasis on post-harvest pest management to preserve the quality and value of stored produce.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- 1,3 Dichloropropene

- Chloropicrin

- Methyl Bromide

- Metam Potassium

- Other Product Type

By Crop Type

- Cereals grains

- Oilseeds pulses

- Fruits vegetables

- Others

By Pest control Method

- Vacuum chamber fumigation

- Tarpaulin

- Structural

- Non-tarp fumigation by injection

- Others

By Form

- Solid

- Liquid

- Gas

By Function

- Insecticides

- Fungicides

- Nematicides

- Herbicides

By Application

- Soil

- Warehouse

Drivers:

Reducing post-harvest losses is crucial for global food security, with fumigation playing a key role in preventing spoilage and maintaining quality. For instance, ammonia gas fumigation effectively controls decay in citrus fruits, preventing issues like green and blue mold. Additionally, fumigation ensures cleanliness in storage areas, reducing contamination risks before and after harvest, thereby preserving the integrity of stored agricultural produce.

Restraints:

Fumigation, while effective in pest control, presents challenges due to residue accumulation on treated materials. Factors such as fumigation conditions and the nature of the fumigants influence residue levels, with some compounds lingering longer than others. Efforts to minimize residues involve optimizing conditions, using less persistent fumigants, and exploring alternative methods, aiming to balance pest control efficacy with safety and quality of agricultural products.

Opportunities:

The phasing out of methyl bromide due to pest resistance has spurred the search for alternative fumigants like phosphine, sulfuryl fluoride, and ethyl formate. Companies are investing in research to develop these alternatives, aiming to create effective pest control methods amidst regulatory changes. This focus on innovation highlights the industry's effort to adapt and ensure continued efficacy in fumigation practices.

Challenges:

The use of volatile chemical fumigants for soil treatment is heavily regulated, requiring appropriate selection for specific applications. Fumigation is labor-intensive and costly, involving specialized equipment and certified pest control specialists. Regulatory compliance, skilled labor, and equipment costs collectively increase the overall expenses of fumigation practices, presenting significant challenges to the industry.