Overview

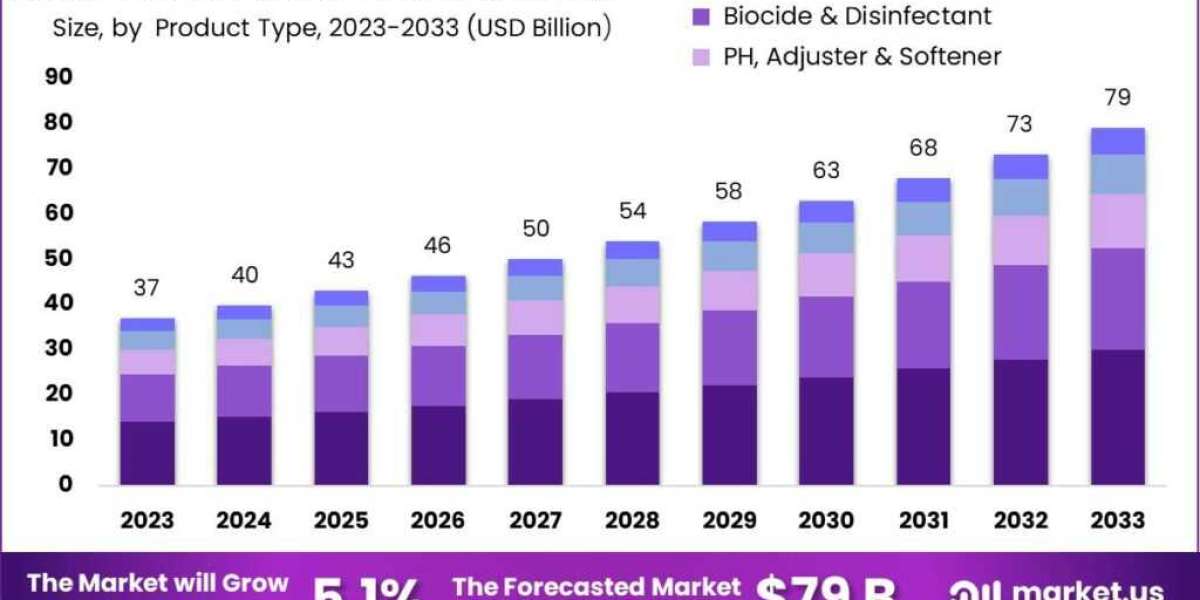

Water Treatment Chemicals Market size is expected to be worth around USD 79 billion by 2033, from USD 37 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The water treatment chemicals market refers to the industry involved in producing and supplying chemicals used to purify and treat water for various purposes. This market is crucial because it supports essential sectors like agriculture, energy production, and municipal water supplies. The demand for water treatment chemicals is driven by several factors, including population growth, industrial expansion, and increasing environmental regulations that require cleaner water standards.

In recent years, regions like Africa and the Middle East have seen significant growth in this market due to their expanding populations and rising industrial activities. Countries in these regions, such as Saudi Arabia, heavily rely on technologies like desalination to meet their water needs, given their arid climates and limited freshwater sources. Desalination involves treating seawater or brackish water to make it suitable for drinking and industrial use, a process that requires specific chemicals like scale inhibitors and coagulants to maintain efficiency and water quality.

Get a Sample Copy with Graphs List of Figures @ https://market.us/report/water-treatment-chemicals-market/request-sample/

As a market research analyst, it's evident that the water treatment chemicals market plays a critical role in ensuring sustainable water resources globally. The market's growth prospects are promising, driven by ongoing urbanization, industrialization, and the need for reliable water supplies in water-stressed regions. Companies in this sector are continually innovating to develop more effective and environmentally friendly chemicals, meeting both regulatory requirements and the growing demand for clean water across various sectors.

Key Market Segments

By Product Type

- Coagulants Flocculants

- Biocide Disinfectant

- pH, Adjuster Softener

- Defoaming Agent Defoamer

- Other product types

By End-Use

- Power

- Oil Gas

- Chemical Manufacturing

- Mining Mineral Processing

- Other End-Uses

In the oil and gas industry, water plays a crucial role across various processes, from refining operations to cooling systems and desalination. Petroleum refineries and chemical plants heavily rely on water for steam production and as a coolant in operations like fluid catalyst cracking units. Consequently, these industries generate substantial volumes of wastewater that require effective treatment solutions. The demand for water treatment chemicals in oil and gas continues to grow as companies prioritize efficient water management to mitigate environmental impact and adhere to stringent regulatory standards.

Маrkеt Key Рlауеrѕ

- SUEZ

- BASF SE

- Ecolab

- Solenis

- Nouryon

- Kemira Oyj

- Dow Chemical Company

- SNF Group

- Cortec Corporation

- Buckman

- Solvay S.A.

- Other Key Players

Driving Factors:

The increasing demand for chemically treated water across industries such as oil gas, power generation, and food beverage is propelling growth in the water treatment chemicals market. With only 2.5% of the world's water being freshwater, industries are turning to these chemicals to efficiently recycle and treat water, beating out more expensive methods like UV filtration and reverse osmosis. Rapid industrial growth in countries like China and India, alongside major projects in energy and mining sectors globally, further boosts this demand.

Restraining Factors:

Alternative water treatment technologies like membrane filtration and UV disinfection are gaining popularity due to their eco-friendly nature and cost-effectiveness. These methods reduce reliance on traditional chemical additives, addressing environmental concerns and lowering operational costs. As industries prioritize sustainability and cost efficiency, the adoption of these alternative technologies poses a challenge to the traditional water treatment chemicals market.

Opportunity:

The Asia Pacific region, particularly China and India, presents significant opportunities for the water treatment chemicals market. With substantial populations and limited freshwater resources, these countries are focusing on improving water quality through stringent environmental regulations and urban development initiatives. This creates a robust demand for water treatment chemicals to support industrial and municipal water management needs.

Challenge:

Developing eco-friendly formulations that meet stringent environmental regulations poses a significant challenge for the water treatment chemicals market. Compliance with regulations from agencies like the EPA drives the need for greener alternatives, despite their potentially higher costs and performance limitations. Moreover, the market faces challenges such as patent infringement and the proliferation of counterfeit products, particularly from Asian manufacturers, which impact market stability and profitability.