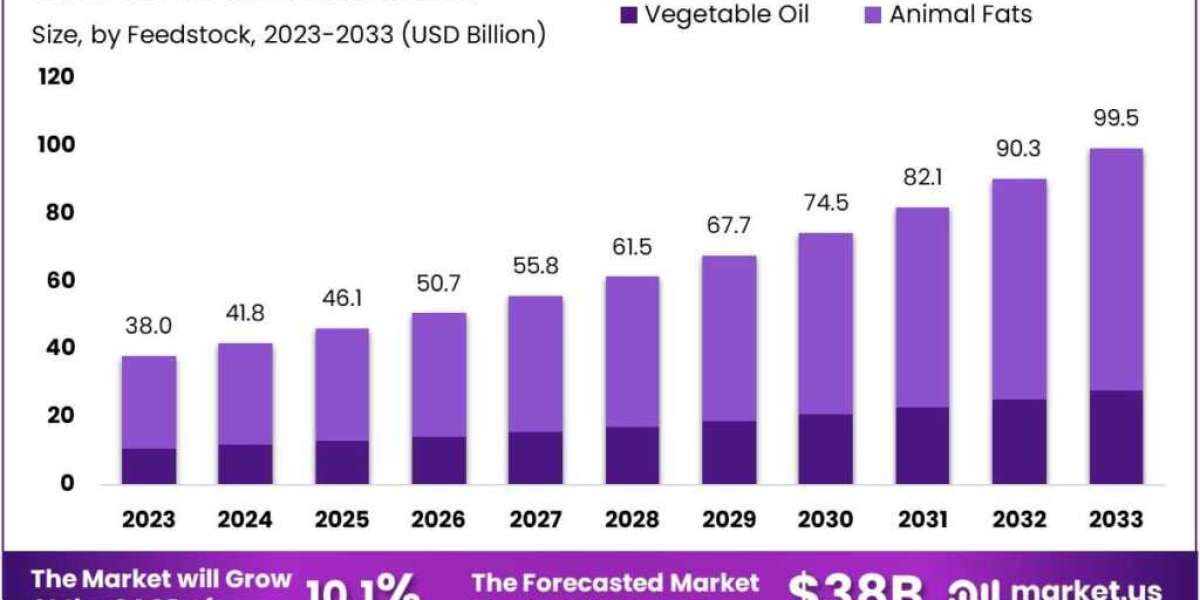

Biodiesel Market size is expected to be worth around USD 101.6 billion by 2033, from USD 38.8 billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2023 to 2033.

The biodiesel market refers to the industry and commercial activities involved in the production, distribution, and consumption of biodiesel fuels. Biodiesel is a renewable, clean-burning substitute for traditional diesel fuel, derived from various organic sources such as vegetable oils, animal fats, and agricultural feedstock.

This market encompasses a wide range of stakeholders, including feedstock suppliers, biodiesel producers, distributors, and end-users, such as power generation companies and the automotive sector. The biodiesel market aims to provide a sustainable alternative to fossil fuels, reducing greenhouse gas emissions and promoting energy security by leveraging domestically sourced renewable resources.

Growth in the biodiesel market is driven by increasing environmental awareness, government policies promoting renewable energy, and the economic benefits associated with using biodiesel as an alternative fuel. The market is characterized by its fragmentation, with numerous small and large-scale producers and suppliers contributing to its development. This fragmentation fosters competitive pricing and innovation within the industry.

Get a Sample Copy with Graphs List of Figures @ https://market.us/report/biodiesel-market/#overview

Key Market Segments

By Feedstock

Vegetable Oil

Soybean Oil

Canola Oil

Corn Oil

Palm Oil

Other Vegetable Oils

Animal Fats

Poultry

White Grease

Tallow

Other Animal Fats

By Application

Fuel

Marine

Automotive

Power Generation

Agriculture

Other Applications

Feedstock Analysis

In 2023, vegetable oil dominated the biodiesel feedstock market, securing over 72% of the share, with palm oil being particularly popular in countries like Indonesia and Thailand, which account for over 80% of global palm oil production and supply significant amounts to Europe for biofuel production.

Application Analysis

Fuel applications led the biodiesel market in 2023, capturing more than 60% of the market share due to its lower VOC emissions compared to diesel, with significant growth expected in the marine industry and agricultural mechanization driving demand.

Key Market Players

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Bunge Ltd.

- Cargill, Inc.

- Ecodiesel Colombia S.A.

- FutureFuel Corp.

- Manuelita S.A.

- Renewable Biofuels, Inc.

- TerraVia Holdings, Inc.

- Wilmar International Ltd.

Driver

The biodiesel market is driven by its potential to reduce emissions, offering an eco-friendly alternative to traditional diesel fuels. Biodiesel is biodegradable, free of harmful aromatic and sulfur compounds, and significantly cuts down greenhouse gas emissions and pollutants. Concerns over greenhouse gas emissions from fossil fuels are pushing the market forward, with biodiesel reducing emissions by up to 50% compared to regular diesel.

Restraint

Despite its benefits, the biodiesel market faces performance concerns. Biodiesel blends can cause higher water separation and fuel foaming compared to regular fuels, leading to injector deposits and corrosion due to the formation of low-molecular-weight acids. Original equipment manufacturers (OEMs) and fuel injection equipment makers have reported real-world damage and power loss in modern direct injection engines when using poor-quality biodiesel blends. To mitigate these issues, diesel fuel additives like flow improvers are necessary to prevent performance problems.

Opportunity

OEM support for biodiesel is growing, significantly boosting its adoption in automotive applications. Major German automakers like DaimlerChrysler, Volkswagen, and Mercedes Benz are extending warranties for vehicles using biodiesel. DaimlerChrysler, for example, plans to enhance engine warranty coverage for vehicles using a 20% biodiesel blend. The U.S. Department of Defense is also shifting its on-road fleets to biodiesel blends, with several state governments following suit.

Challenge

The easy availability of raw materials in emerging regions like the Asia-Pacific is leading to overcapacity in the biodiesel market. The abundance of primary ingredients such as palm oil, animal tallow, soy oil, palm kernel oil, and coconut oil in these regions reduces entry barriers, attracting numerous manufacturers. This influx of producers has resulted in an oversupply, necessitating the export of surplus biodiesel and triggering a price war in local markets.